The Mechanisms of Payin and Payout

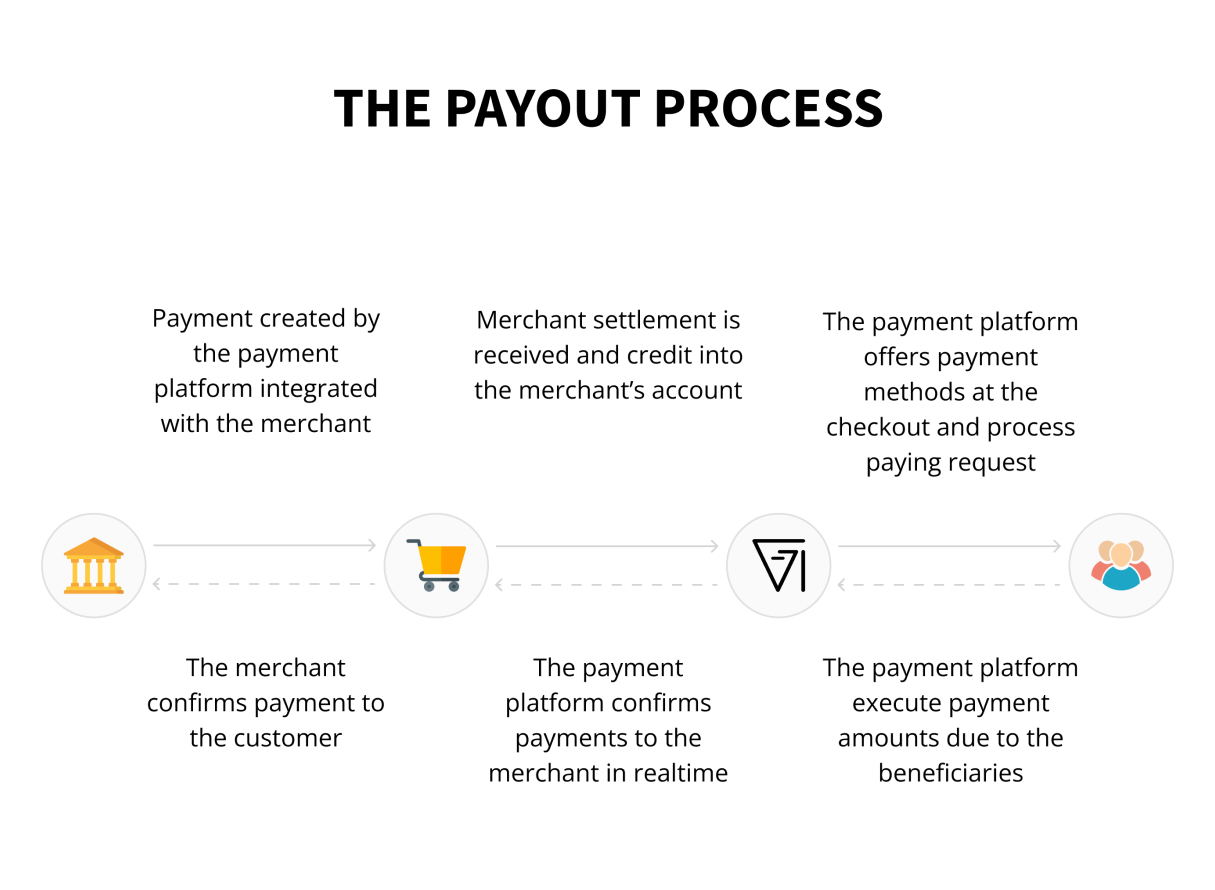

Mechanisms called payout and paying control how money moves during financial transactions. The term "paying" describes the procedure of depositing money into a specific account or system, which is normally started by the payer. Rainet Technology offers comprehensive pay-in and payout solutions to streamline your payment processes.

It entails moving money to the selected receiver or recipient account from a source such as a bank account, credit card, or digital wallet. Payout, on the other hand, describes the distribution or removal of money from a system or account. It entails transferring funds from the system or account to the recipient account or intended recipient. Financial transactions such as payments, withdrawals, refunds, and settlements are all made possible by paying and payout procedures, which guarantee an easy and secure flow of money.